PAVE EV Loan Process October 2025 – Step by Step Apply Guide

Owning an electric motorcycle or rickshaw in Pakistan is no longer just a dream. With the launch of the PAVE EV Loan Process, the government has introduced a structured subsidy and financing system that makes eco-friendly vehicles affordable for everyone.

Through the NEV Policy 2025–30, thousands of citizens now have the chance to apply for electric bikes and rickshaws without facing heavy interest rates or high upfront costs.

Understanding the application journey is important before you apply. This article breaks down the process in simple steps, from filling out the online form to loan approval, so you can easily benefit from this revolutionary scheme. By following the right procedure, you can secure your electric vehicle under PAVE and start enjoying cheaper, cleaner, and more reliable transportation.

Check Also: Electric Vehicles in Pakistan: The Future of Transportation – PAVE Program

Why the PAVE EV Loan Process is Important

Electric vehicles (EVs) are still new in Pakistan, and their upfront costs can be challenging for middle-class families, students, delivery riders, and small business owners. To bridge this affordability gap, the government has partnered with commercial banks to provide:

- Subsidized loans up to Rs. 200,000 for electric bikes

- Loans up to Rs. 880,000 for electric rickshaws and loaders

- Two- and three-year installment options with no hidden charges

- Low to zero interest rates backed by government support

By following the PAVE EV Loan Process, applicants can easily finance their vehicles and pay in small monthly installments rather than a lump sum.

Step by Step: PAVE Gov PK Loan Process 2025

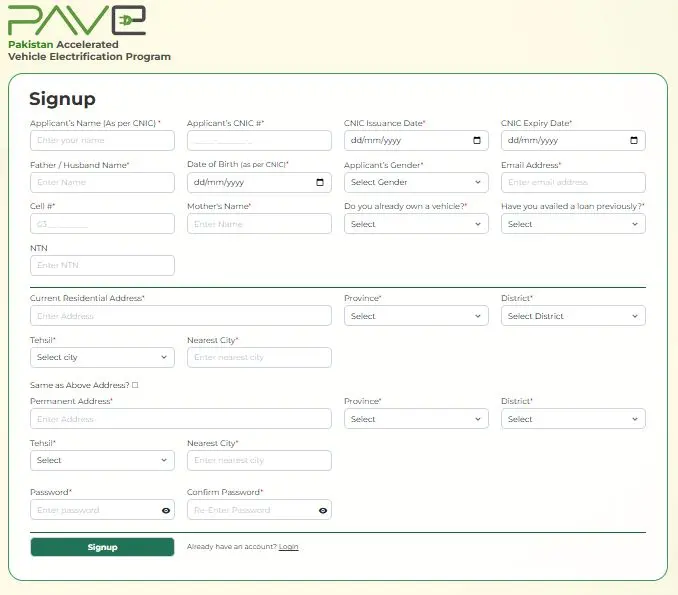

Step 1: Registration on PAVE Portal

Applicants must start by creating an account at www.pave.gov.pk.

- Enter CNIC, mobile number, and email.

- Verify identity with OTP.

- Fill in personal, residential, and financial details.

Step 2: Document Submission

The next stage is uploading required documents:

- Scanned CNIC (front and back)

- Income proof or salary slip (if applicable)

- Utility bill (for address verification)

- Passport-size photograph

- Driving license (mandatory for rickshaw applicants)

Step 3: Loan Request Form

After registration, applicants must select the vehicle type (bike, rickshaw, or loader) and request a loan under the scheme.

The form includes:

- Desired subsidy amount (Rs. 80,000 for bikes, Rs. 400,000 for rickshaws)

- Loan requirement (remaining balance)

- Preferred installment plan (monthly or quarterly)

Step 4: Bank Processing

Partner banks receive the loan request automatically through the PAVE system. Banks then:

- Verify the applicant’s CNIC with NADRA

- Cross-check credit history

- Approve or reject the loan request

Step 5: Approval Notification

Once the loan is approved, applicants receive an SMS and an email. The PAVE EV Loan Process ensures quick turnaround times—usually 7–10 working days.

Step 6: Balloting for Subsidy

Approved applicants are entered into the computerized balloting. If selected, the subsidy is applied, and the loan terms are finalized.

Step 7: Vehicle Delivery

After balloting, successful applicants are notified about delivery timelines. The loan is disbursed directly to the manufacturer/dealer, and the applicant begins repayment according to their installment plan.

Loan Limits under PAVE Program 2025

- Electric Bikes:

- Subsidy: Rs. 80,000

- Loan: Up to Rs. 200,000

- Installments: 24 months

- Electric Rickshaws / Loaders:

- Subsidy: Rs. 400,000

- Loan: Up to Rs. 880,000

- Installments: 36 months

This structure ensures that even those with limited income can afford eco-friendly vehicles.

Benefits of Pakistan EV Loan Scheme 2025

- Affordable Ownership – Small monthly installments instead of paying the full price at once.

- Government-Backed Loans – Low risk of rejection as the state guarantees first-loss coverage.

- Inclusive Access – Reserved quotas for women, students, delivery workers, and rural applicants.

- Transparent Approval – Digital tracking through the official PAVE portal.

- Environment-Friendly Choice – Lower fuel costs and zero emissions.

Common Issues in the NEV Policy 2025 EV Loan

- Rejected Applications – Often due to incomplete documents.

- Delays in Bank Approval – May take longer during peak periods.

- Loan Limits – Applicants sometimes request more than the approved maximum.

- Balloting Requirement – Not everyone who applies for the loan gets selected; it depends on quota allocation.

How to Improve Your Loan Approval Chances

- Ensure your CNIC is valid and matches your SIM registration.

- Upload clear, high-quality documents.

- Provide accurate income details to prove repayment capacity.

- Apply early within the registration window (1–30 September 2025).

Future of PAVE Financing in Pakistan

The government plans to expand the PAVE EV Loan Process to cover electric cars in future phases. By 2030, over 2 million EVs are expected to be financed under this program, creating an affordable and sustainable ecosystem for green transport.

Why PAVE EV Loan Process 2025 is Important

The PAVE EV Loan Process 2025 is important because it makes eco-friendly transport affordable for ordinary citizens who could not otherwise buy electric bikes or rickshaws. By combining subsidies with easy monthly installments, the program reduces financial pressure and encourages more people to adopt clean mobility. This not only helps individuals save on rising fuel costs but also supports Pakistan’s broader mission of reducing pollution and promoting sustainable transport.

FAQs about PAVE EV Loan Process 2025

Q1: What is the maximum loan for electric bikes?

Up to Rs. 200,000 with 2-year installment plans.

Q2: Can women apply for loans under PAVE?

Yes, 25% quota is reserved for women applicants.

Q3: How long does the loan approval take?

Usually between 7–10 working days after application submission.

Q4: Do I need collateral for the loan?

No, loans are government-backed with first-loss coverage for banks.

Q5: What if my loan request is rejected?

You can reapply with corrected documents before the deadline.

Q6: How is subsidy applied with the loan?

The subsidy reduces the vehicle’s total cost, and the loan covers the remaining balance.

Q7: Is the loan interest-free?

For bikes, yes. For rickshaws, minimal interest may apply, but rates are heavily subsidized.

PAVE Loan Installments Pakistan 2025-30 Conclusion

The PAVE EV Loan Process is a practical solution that brings electric mobility within reach of everyday Pakistanis. By combining government subsidies with simple installment plans, it removes the financial barrier that once kept eco-friendly vehicles out of the hands of ordinary citizens. The digital system adds further transparency, making sure applicants can track their progress without stress or confusion. This approach not only supports cleaner transport but also empowers people to take part in a greener future.

For those considering an application, the process is straightforward—visit the official portal at www.pave.gov.pk, upload the required documents, and let the partner banks guide you through loan approval. By completing these steps, applicants can confidently move forward in securing an electric bike or rickshaw and play an active role in Pakistan’s transition toward sustainable, affordable, and modern transportation.