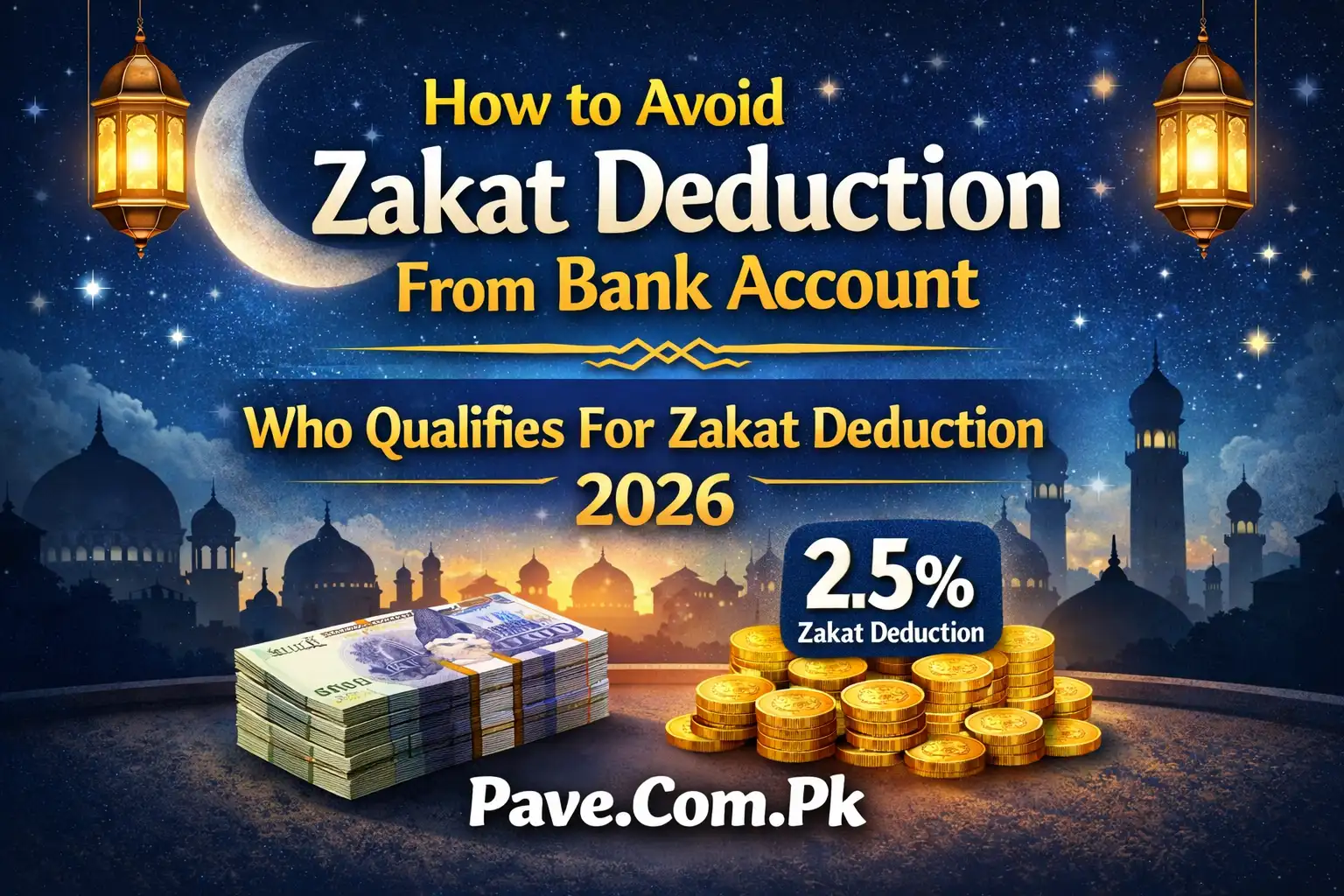

How to Avoid Zakat Deduction From Bank Account | Who Qualifies For Zakat Deduction 2026

As Ramazan 2026 approaches, many people in Pakistan are searching on Google:

- How to avoid Zakat deduction from bank account?

- Who qualifies for Zakat deduction 2026?

- Zakat exemption form Pakistan

- Bank Zakat deduction rules 2026

- CZ-50 form last date

If you have savings in a bank account, it is very important to understand how automatic Zakat deduction works in Pakistan and what options you have.

In this detailed guide, I will explain everything in easy English, including eligibility, exemption process, account types, and legal rules.

What Is Bank Zakat Deduction in Pakistan?

In Pakistan, Zakat is deducted automatically from eligible bank accounts under the Zakat and Ushr Ordinance 1980. This system was introduced during the government of Muhammad Zia-ul-Haq.

Every year, on the 1st of Ramazan, banks deduct:

2.5% Zakat

from accounts that have balance equal to or above the announced Nisab amount.

The deducted money goes to the Central Zakat Fund and is later distributed among deserving people.

What Is Nisab for 2026?

Nisab is the minimum amount of wealth a Muslim must have before Zakat becomes compulsory.

In Pakistan, Nisab is usually calculated based on the value of silver, not gold.

The expected Nisab for Ramazan 2026 is estimated between:

Rs. 150,000 to Rs. 180,000

(Exact amount is officially announced before Ramazan.)

If your bank balance on the Zakat deduction date is equal to or more than Nisab, Zakat will be deducted automatically.

Who Qualifies for Automatic Zakat Deduction?

Many people think everyone’s bank account is deducted. That is not true.

Zakat is deducted only if:

✔ Your account is a savings or profit-based account

✔ Your balance is equal to or above Nisab

✔ You have not submitted a Zakat exemption form (CZ-50)

✔ The amount has remained in account

Types of Accounts From Which Zakat Is Deducted

Zakat is deducted from:

- Savings Accounts

- Profit & Loss Sharing (PLS) Accounts

- Islamic Savings Accounts

- Certain Fixed Deposits

- Some investment accounts

If your account gives profit, it is likely included.

Accounts That Are Exempt From Zakat Deduction

Zakat is NOT deducted from:

- Current accounts

- Foreign currency accounts

- Government accounts

- Minor accounts (in some cases)

- Zakat-exempt accounts (with CZ-50 form submitted)

This is why many people transfer money from savings to current account before Ramazan.

How to Avoid Zakat Deduction From Bank Account 2026

Now the most important question:

How can you legally avoid automatic Zakat deduction?

Here are the official methods:

1. Submit CZ-50 Zakat Exemption Form

This is the safest and legal method.

The CZ-50 form is an affidavit declaring that:

- You will pay Zakat personally

- You do not want automatic deduction

Steps:

- Get CZ-50 form from bank

- Fill and sign it

- Get it attested (if required)

- Submit before deadline (usually before Ramazan)

After approval, your account becomes permanently exempt unless you cancel it.

This method is commonly used by people who follow Shia fiqh or prefer personal Zakat distribution.

2. Transfer Money to Current Account

Zakat is not deducted from current accounts.

Some people temporarily transfer money to:

- Current account

- Business current account

before the 1st of Ramazan.

However, remember:

If you are Islamically eligible for Zakat, you must still pay it yourself.

Avoiding deduction does not cancel religious obligation.

3. Withdraw Money Before Deduction Date

Some people withdraw cash before midnight of 1st Ramazan.

But this method is not recommended because:

- It may create financial inconvenience

- It is not spiritually appropriate if you are eligible

- Islam encourages honest fulfillment of obligation

Who Should Not Avoid Zakat Deduction?

If:

- Your savings are above Nisab

- One lunar year has passed

- You have no heavy debts

Then you are Islamically obligated to pay Zakat.

In that case, avoiding deduction only shifts responsibility to you. You must calculate and distribute it properly.

Who Qualifies for Zakat in 2026?

Now let’s understand who qualifies to receive Zakat.

According to Islamic teachings, Zakat can be given to:

- Poor people (Fuqara)

- Needy (Masakeen)

- Debtors

- Travelers in difficulty

- Widows

- Orphans

- People struggling financially

Zakat cannot be given to:

- Parents

- Children

- Husband or wife

- Rich people

Important Zakat Deduction Date 2026

Zakat is deducted on:

1st Ramazan 1447 AH (Expected March 2026)

Banks check balance at midnight.

If your account meets Nisab criteria at that moment, deduction will occur.

Common Google Searches About Zakat Deduction

People frequently search:

- How to stop Zakat deduction from bank account Pakistan

- CZ-50 form download

- Zakat exemption last date

- Is Zakat deducted from current account?

- What is Nisab for 2026 in Pakistan?

- Bank Zakat deduction rules

This shows many people are confused before Ramazan.

Difference Between Legal Avoidance and Religious Duty

It is important to understand:

Legal avoidance = Stopping automatic bank deduction

Religious obligation = Paying Zakat if eligible

Even if you avoid bank deduction, you must pay Zakat if you meet Islamic conditions.

How to Calculate Your Zakat Properly

To calculate:

- Add bank savings

- Add gold & silver value

- Add business stock

- Add cash in hand

- Subtract debts

- If remaining amount ≥ Nisab → Pay 2.5%

Example:

If total wealth = Rs. 400,000

Zakat = 400,000 × 2.5%

= Rs. 10,000

What Happens If You Don’t Pay Zakat?

From Islamic perspective:

- Zakat is compulsory

- Not paying without reason is sinful

- It affects barakah in wealth

From legal perspective:

If deduction is avoided legally, government does not penalize you. But religious accountability remains.

Should You Submit CZ-50 Form in 2026?

Submit CZ-50 if:

- You want to distribute Zakat yourself

- You follow a different fiqh

- You calculate Zakat differently

- You want full control over recipients

Do NOT submit if:

- You prefer government deduction

- You are unsure about manual calculation

Key Tips Before Ramazan 2026

✔ Check official Nisab announcement

✔ Review your bank account type

✔ Decide whether to submit CZ-50

✔ Calculate your Zakat in advance

✔ Avoid last-minute confusion

Final Thoughts

Understanding How to Avoid Zakat Deduction From Bank Account 2026 and Who Qualifies for Zakat Deduction is very important before Ramazan begins.

You have legal options like submitting CZ-50 or using current accounts. However, if you meet Nisab conditions, paying Zakat is your religious responsibility.

Prepare early, calculate honestly, and ensure your wealth is purified in the best possible way.