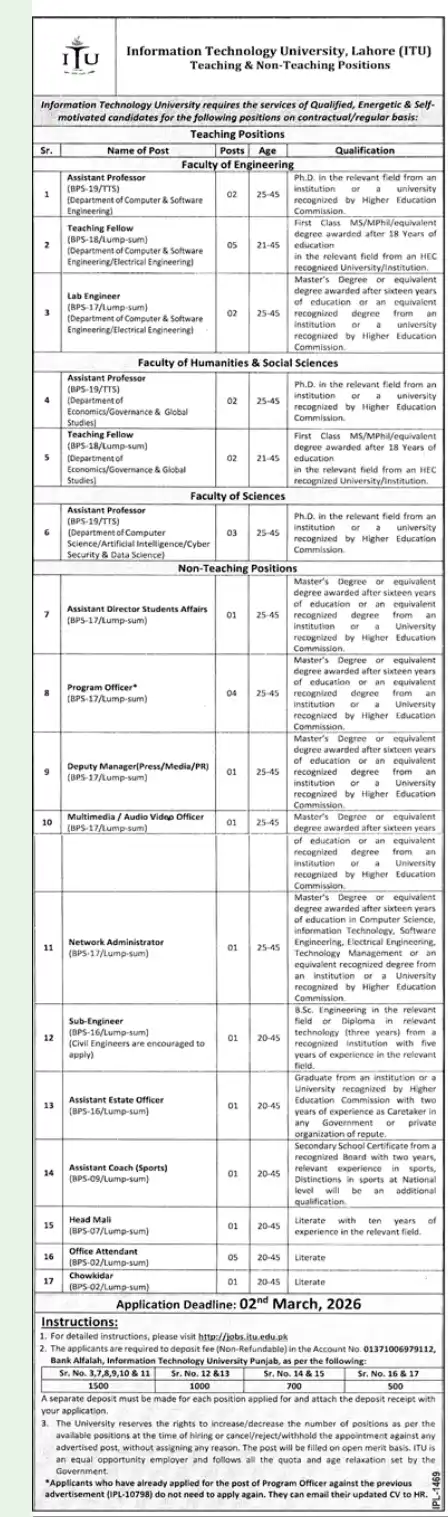

Salaried Class Emerges as Top Income Tax Contributor

Pakistan’s salaried class has once again emerged as the largest contributor to income tax revenue, paying more than exporters, retailers, and the property sector combined during the first seven months of Fiscal Year 2026 (FY26). The latest data from the Federal Board of Revenue (FBR) highlights the growing tax burden on documented workers and raises serious questions about tax fairness in Pakistan.

According to official FBR statistics, salaried individuals paid Rs. 315 billion in income tax between July and January FY26. In comparison, exporters, retailers, and property market participants collectively contributed Rs. 293 billion during the same period.

This means the salaried class paid Rs. 22 billion more than these three powerful sectors combined.

FBR Tax Collection Data FY26: Key Figures

The Federal Board of Revenue (FBR) released detailed tax collection data showing:

- Salaried class income tax: Rs. 315 billion

- Exporters total contribution: Rs. 101 billion

- Retailers total contribution: Rs. 40 billion

- Property sector (sale + purchase): Rs. 152 billion

- Combined total of three sectors: Rs. 293 billion

These numbers clearly show that salaried workers are carrying a heavier share of Pakistan’s income tax burden.

Why Is the Salaried Class Paying More Tax in Pakistan?

The main reason is documentation and transparency. Salaried employees in both public and private sectors have their income tax deducted directly at source through payroll systems.

This system ensures:

- Automatic tax deduction

- No underreporting of income

- Higher compliance rate

Unlike many businesses and traders, salaried individuals have limited options to avoid taxation.

Exporters’ Income Tax Contribution in FY26

- Rs. 50 billion in direct income tax

- Rs. 51 billion as 1% advance tax

Total contribution: Rs. 101 billion

Interestingly, this figure remains almost unchanged compared to last year.

Despite being a major foreign exchange earning sector, exporters benefit from various tax incentives and concessions under government policy to promote exports.

Retailers’ Tax Contribution and Advance Tax System

Retailers operate nearly 3 million outlets across Pakistan. However, their tax contribution remains relatively low compared to the salaried class.

Retailers paid:

- Rs. 15 billion under Section 236G

- Rs. 25 billion under Section 236H

Total retailer contribution: Rs. 40 billion

This amount is significantly lower considering the size of Pakistan’s retail market.

Property Sector Income Tax Collection

The property sector contributed:

- Rs. 105 billion under Section 236C (sale of property)

- Rs. 47 billion on purchase and transfer

Total property tax collection: Rs. 152 billion

Property tax rates under FY26:

- 4.5% for ATL persons (transactions up to Rs. 50 million)

- 5% for transactions between Rs. 50–100 million

- 5.5% for transactions above Rs. 100 million

- 11.5% for non-ATL individuals

Despite high transaction values, the overall tax collected from property remains lower than payroll tax.

IMF Review and Pressure on Tax Reforms

Pakistan is preparing for another IMF review. The International Monetary Fund has consistently emphasized:

- Broadening the tax base

- Reducing reliance on salaried taxpayers

- Increasing taxation of undocumented sectors

The newly established Tax Policy Office at the Ministry of Finance will face pressure to demonstrate reform progress.

Many experts believe the IMF may push for higher taxation of retailers and real estate.

Tax Fairness Debate in Pakistan

The issue raises an important question:

Is Pakistan’s tax system fair?

The salaried class argues that:

- They pay taxes regularly

- They have no exemptions

- They face increasing inflation

- They do not receive proportional public services

Meanwhile, large segments of the economy remain under-taxed.

Growth in Salaried Class Tax Collection

Income tax from salaried individuals increased from:

- Rs. 284 billion (FY25)

to - Rs. 315 billion (FY26)

This Rs. 31 billion increase shows growing dependence on payroll taxes.

Higher salary slabs and rising wages may also contribute to this increase.

Impact on Middle Class in Pakistan

The middle class faces:

- High income tax rates

- Rising electricity bills

- Increased fuel prices

- Inflationary pressure

When the tax burden increases, disposable income decreases.

This affects:

- Consumer spending

- Savings rate

- Economic growth

Why Retail and Property Sectors Remain Lightly Taxed

Experts point to several reasons:

- Political influence

- Cash-based transactions

- Weak documentation

- Underreporting of income

- Lobby pressure

These sectors often negotiate tax relief during budget discussions.

Importance of Broadening the Tax Base

Pakistan’s tax-to-GDP ratio remains low compared to regional economies.

To improve fiscal stability, the government must:

- Document informal sectors

- Digitalize retail payments

- Improve property valuation systems

- Strengthen FBR enforcement

Without broadening the tax base, pressure on the salaried class will continue.

Government’s Perspective

Officials argue that:

- Payroll tax collection is efficient

- Retail digitization is ongoing

- Property tax reforms have been introduced

- Export sector incentives are necessary for economic growth

However, critics say reforms are slow and insufficient.

Section 236C and 236H Explained

These are advance tax sections under Income Tax Ordinance:

- Section 236C: Tax on sale of immovable property

- Section 236H: Advance tax on retailers

These mechanisms aim to collect tax at transaction level.

However, they may not reflect actual profit margins.

Long-Term Economic Consequences

If the salaried class continues to bear disproportionate tax burden:

- Brain drain may increase

- Skilled workers may migrate

- Tax morale may decline

- Trust in institutions may weaken

Balanced taxation is essential for sustainable economic growth.

Possible Reforms in FY27 Budget

Experts expect:

- Review of income tax slabs

- Retail digitization incentives

- Real estate valuation reforms

- Reduction in payroll tax pressure

The IMF review may influence these decisions.

Conclusion

The latest FBR data clearly shows that Pakistan’s salaried class paid more income tax than exporters, retailers, and the property sector combined in the first seven months of FY26.

While exporters and property transactions contribute to the economy, the heavy reliance on payroll taxation raises serious concerns about fairness and sustainability.

If Pakistan aims to achieve economic stability and IMF program targets, broadening the tax base and ensuring equitable taxation across sectors will be essential.

The debate over tax justice in Pakistan is likely to intensify as the FY27 budget approaches.